This page is part of the report Building Prosperity: Unlocking the Potential of a Nature-Positive, Circular Economy for Europe. Explore the full report to delve into all focus areas, strategies, and key recommendations, or browse the entire case study collection to see these strategies in action.

Strategy: Revitalising vacant commercial property

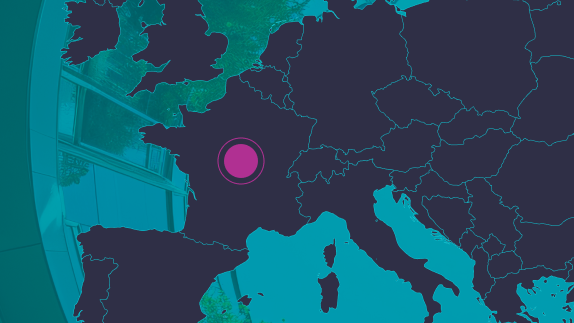

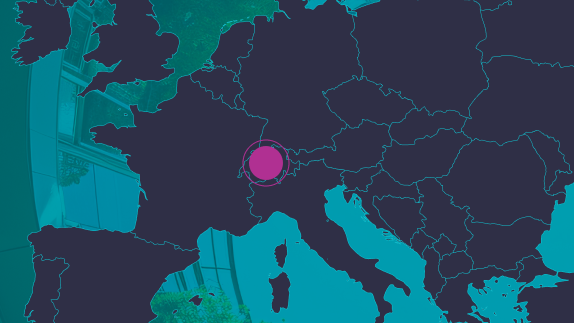

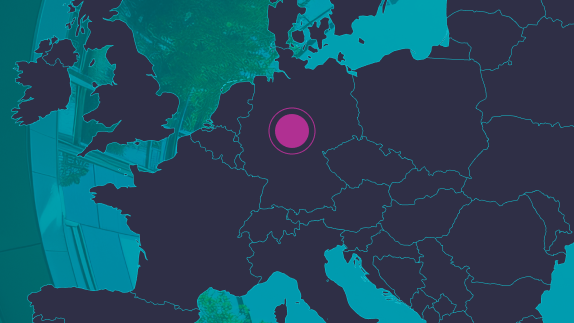

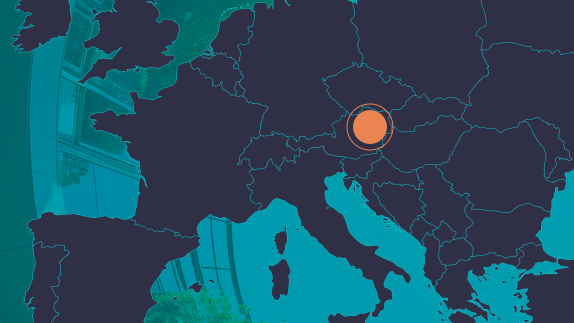

Location: Switzerland

Organisation: Ginkgo

Europe’s urban landscapes bear the marks of its industrial past, with many prime-location unused spaces from various sectors. These sites offer significant development potential for housing and city revitalisation, aligning with strategies to limit urban sprawl and protect natural habitats. However, repurposing these brownfield sites is challenging due to potential contamination.

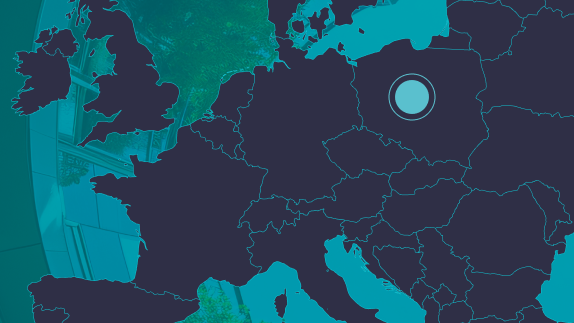

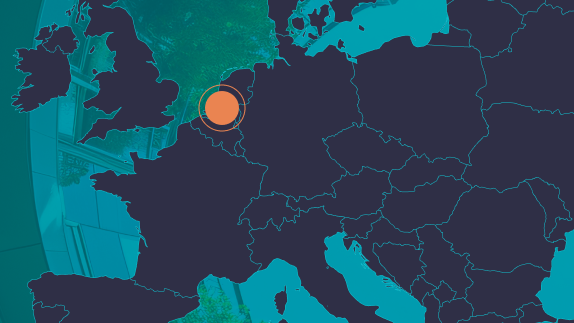

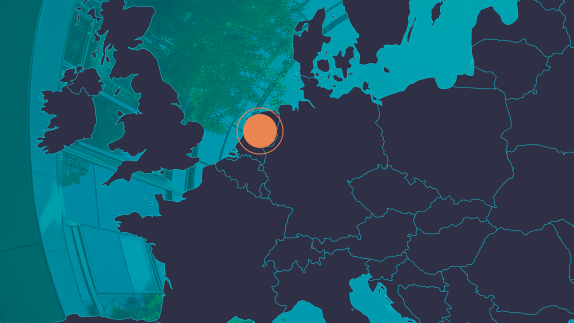

Ginkgo specialises in the remediation and regeneration of brownfield sites and abandoned built environment assets, including train depots, gas works, and more. Ginkgo is in the process of transforming 110 hectares of ex-industrial land across France, Spain, Belgium, Portugal, Italy, and the Netherlands into over 1 million m2 of mixed-use central urban developments. One notable project is a 4.5-hectare plot in Lyon, once the ‘Fagor-Brandt’ factory site, now an ecodistrict with extensive building rights. Already, over 40,000 m2 is developed as housing, featuring 35% green space and 200 trees, with plans for an additional 9,000 m2 of greenery and an urban farm in the commercial sector. Ginkgo’s Lyon project required more than EUR 7 million of initial funding for site remediation.

The profitability of large-scale brownfield development projects presents an attractive long-term opportunity for investors. Funds from institutional investors including Banque de Territoires, Allianz France, and a range of European diversified investors enable Ginkgo’s projects to avoid the need for public grants or subsidies. Strategic site selection in urban areas with robust transport networks enhances the projects’ profitability and competitiveness. Additionally, prioritising mixed-use developments not only diversifies the investment but also boosts community benefits and financial viability, underlining the project’s economic and social value.

Ginkgo has demonstrated that revitalising brownfield sites, especially in secondary cities where land is often significantly discounted, can be very profitable for investors. Already, the project has returned more than three times the equity invested, with an internal rate of return (IRR) of over 20%. A key part of the transformation story from industrial wasteland into a vibrant ecodistrict hinges on 40% of the 42,000 m2 of residential space created being set aside for social housing. Meanwhile, the project is contributing EUR 10 million to urban development taxes and infrastructures, including green spaces, roads, and schools.