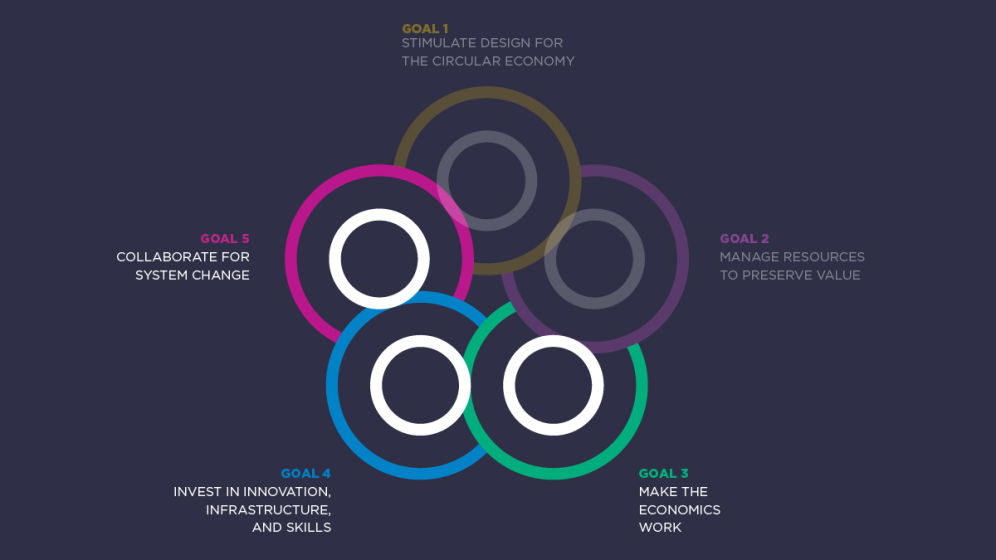

Part of a series of case studies that exemplify elements of the Universal Circular Economy Policy Goals (2021) in practice.

Although recent years have seen steep growth in circular economy financing, far more capital and activity for scaling the circular economy is needed. To attract foreign and domestic investments into circular activities, Japan published the world’s first government-formulated guidance on disclosure and engagement that specifically targets the circular economy.

In brief

In January 2021 Japan’s Ministry of Economy, Trade and Industry and Ministry of the Environment published the Disclosure and Engagement Guidance to Accelerate Sustainable Finance for a Circular Economy to unlock more investment in the circular economycircular economyA systems solution framework that tackles global challenges like climate change, biodiversity loss, waste, and pollution. It is based on three principles, driven by design: eliminate waste and pollution, circulate products and materials (at their highest value), and regenerate nature..

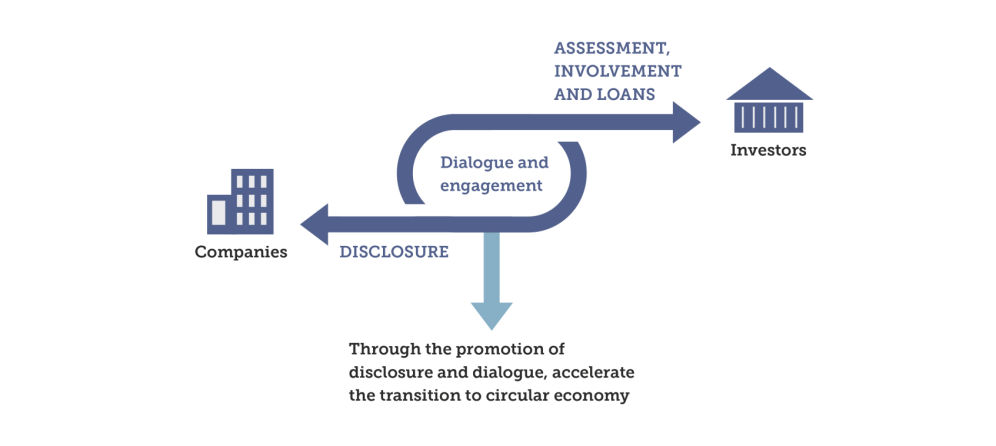

The guidance encourages companies to communicate to investors how, through their circular economy activities and innovative technologies, they can provide return on investments. Using existing financial frameworks, the Japanese government is exploring ways to embed circular economy considerations into business strategies, investment decisions, and dialogues between companies and investors.

Policy background

The Disclosure and Engagement Guidance to Accelerate Sustainable Finance for a Circular Economy follows a series of policy developments in Japan intended to support the transition to a circular economy. In 2000, the government established the Basic Act for Establishing a Sound Material-Cycle Society, a significant step forward in the country’s approach to waste management. This led to the first Fundamental Plan for Establishing a Sound Material-Cycle Society in 2003, which laid the foundations for the development of a regulatory framework for a circular economy in Japan. The government revises the plan every five years, with the fourth plan, published in 2018, stating financial institutions and investors are expected to provide funds to companies, non-profit organisations and projects that work to create a “sound material-cycle society”.

The new guidance is the first government-formulated guidance on disclosure and engagement that specifically targets the circular economy.

Who was involved?

The disclosure and engagement guidance was developed by the Ministry of Economy, Trade, and Industry (responsible for industrial and business policy) together with the Ministry of Environment (responsible for waste management), complemented by information exchange with the Financial Services Agency, with input from a study group composed of companies, business associations, financial institutions, research institutions, and academics.

What does the guidance mean…

For companies

Comprehensively communicate their values, business models, strategies, governance to investors

Refer to guidance when preparing integrated reports and annual reports, identifying circular economy as corporate materiality

The guidance outlines how companies can embed circular economy thinking into their business strategies, activities and decisions, to scale circular economy innovations and technologies, and increase their competitiveness. For instance, circular economy principles can be incorporated into a business’s corporate values, business models and annual reports; and by aligning a “Plan-Do-Check-Act” cycle with circular economy targets, companies can embed circular thinking into decisions at all levels, from the board of directors to the executive level. The guidance includes five case studies that demonstrate how Japanese companies are already putting this into practice.

For investors

Use in stewardship activities aimed at increasing corporate value and sustainable growth of investee companies from a medium to long-term perspective

Circular economy strategies can help de-risk investments and drive superior risk-adjusted returns for investors and financial institutions. The guidance helps investors incorporate circular economy considerations into their engagement and stewardship activities with companies. It encourages dialogue between asset owners and asset management organisations on the circular economy opportunity to tap into new sources of long-term growth and value creation, while delivering on ESG-related goals and targets.

Diagram showing the interaction between companies and investors through the guidance

What’s in the guidance?

Values: companies should embed circular economy thinking into their corporate values and use it to guide their business decisions.

Business model: companies should disclose how their circular economy activities will affect or change their business model, generate value, and maintainmaintainKeep a product in its existing state of quality, functionally and/or cosmetically, to guard against failure or decline. It is a practice that retains the highest value of a product by extending its use period. their competitive advantage in the market.

Risks and opportunities: companies should summarise the legal, technological, market, and reputational risks and opportunities that will arise from adopting a more circular business model. (aligned with the TCFD)

Strategy: companies should explain how they will secure and strengthen the management of the resources and assets that will support the competitive advantage of their circular business model, as well as manage risks in the medium to long term. (aligned with the TCFD)

Indicators and targets: companies with circular economy ambitions should set their targets and KPIs to measure and report on their progress towards circularity. (aligned with the TCFD)

Governance: companies should show how management and the board of directors are actively involved in a company's circular economy activities and policies on the topic, to demonstrate to investors the effectiveness of their governance system. (included in the TCFD)

The six key points of disclosure and engagement in the guidance are closely aligned with several internationally recognised frameworks such as that of the Task Force on Climate-related Financial Disclosures, as well as the 2017 Japanese “Guidance for Collaborative Value Creation”.

Outcomes and lessons learned

It is too early to assess the impacts of this guidance. However, as it is built upon existing Japanese guidance and the TCFD and other international frameworks, it is likely that companies in Japan with circular economy ambitions will use it in dialogues with their investors. Identifying how the circular economy contributes to existing ESG targets, such as climate change mitigation and biodiversity restoration, can further help companies adopt a more circular approach.

Encouraging companies to disclose and report their circular economy activities can help gather information about the uptake of circular economy practices. These insights help to inform investment decisions and future policy developments.

Illustrating the Universal Circular Economy Policy Goals

Part of a series of case studies that exemplify elements of the Universal Circular Economy Policy Goals (2021) in practice.

Download

Japan’s disclosure and engagement guidance is available in: English